In the realm of financial security, insurance plays a pivotal role. Understanding the nuances of insurance, especially the essentials of Tianlai insurance, is crucial for making informed decisions. This article presents a comprehensive insurance knowledge checklist in English, focusing on the essentials of Tianlai insurance.

I. Introduction to Insurance

Insurance is a risk management tool that provides financial protection against potential losses. It allows individuals and businesses to transfer risks to an insurance company, which in turn provides a financial cushion in times of need. Insurance policies come in various types, such as life, health, property, and vehicle insurance. Each type covers specific risks and provides a safety net in case of accidents or other unforeseen events.

II. Tianlai Insurance Overview

Tianlai insurance refers to a comprehensive insurance plan that covers various risks related to personal and property safety. It typically includes life, health, property, and vehicle insurance, among others. This type of insurance is designed to provide comprehensive protection for individuals and families against potential losses.

III. Key Elements of Tianlai Insurance Knowledge Checklist

Types of Insurance Covered:

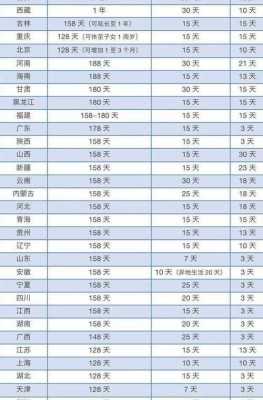

a. Life Insurance: This type of insurance provides financial support to beneficiaries in case of the policyholder's death or disability. It ensures that the family is financially secure even in the absence of the main breadwinner.

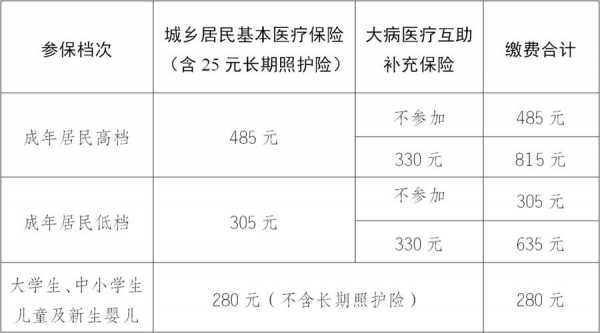

b. Health Insurance: Health insurance covers medical expenses incurred due to illness or injury. It provides a financial cushion for medical treatments and ensures that the policyholder does not have to bear the entire cost out of pocket.

c. Property Insurance: Property insurance covers losses incurred due to damage or destruction of physical assets such as houses, cars, and other valuable items. It provides financial support to repair or replace these assets in case of an accident or natural disaster.

d. Vehicle Insurance: Vehicle insurance covers losses incurred due to accidents involving vehicles such as cars and motorcycles. It provides financial support for repairs, medical expenses, and other related costs.

Insurance Policies and Contracts:

a. Understanding the Policy: It is essential to understand the terms and conditions of the insurance policy before purchasing it. The policy should clearly state the coverage, exclusions, and benefits provided by the insurance company.

b. Contractual Obligations: Both the insurer and the policyholder have certain obligations under the contract. It is important to understand these obligations to ensure that both parties fulfill their responsibilities.

c. Claim Process: It is crucial to understand the claim process in case of a loss or accident. This includes the steps to be taken, documents required, and the time frame for submitting a claim.

Risk Assessment and Premiums:

a. Risk Assessment: Insurance companies assess the risk associated with each policyholder and the type of coverage required. This assessment helps determine the premium amount and the level of coverage provided.

b. Premiums: Premiums are the amounts paid by the policyholder to the insurance company for coverage. It is important to understand how premiums are calculated and the factors that affect them.

Claims and Settlement:

a. Reporting a Claim: It is essential to know how and when to report a claim in case of a loss or accident. The policyholder should contact the insurance company immediately and provide them with the necessary information and documents.

b. Settlement Process: The settlement process involves assessing the claim, verifying the documents provided, and making a decision on whether or not to approve the claim. It is important to understand the time frame for settlement and the factors that may affect it.

IV. Conclusion

Understanding Tianlai insurance and its various components is crucial for making informed decisions about financial security. The above checklist provides an overview of the key elements that should be considered when purchasing or understanding Tianlai insurance. It is essential to carefully review the policy terms, understand the contract obligations, and be familiar with the claim process in case of a loss or accident. By having a comprehensive understanding of Tianlai insurance, individuals and families can ensure that they have adequate protection against potential losses and enjoy peace of mind knowing that they are financially secure in times of need.