In today's world, insurance has become an essential part of our financial security. However, many people still have limited knowledge about insurance and its importance. This article aims to provide a comprehensive overview of insurance, including its types, benefits, and how to choose the right policy for you.

I. Introduction to Insurance

Insurance is a risk management tool that provides financial protection against potential losses. It allows individuals and businesses to transfer risks to an insurance company in exchange for a premium. If a loss occurs that is covered by the policy, the insurance company will pay a claim to the policyholder.

II. Types of Insurance

There are various types of insurance available, each designed to protect against different risks. Some of the most common types of insurance include:

1、Life Insurance: This type of insurance provides financial protection for your loved ones if you pass away. It pays a death benefit to your beneficiaries.

2、Health Insurance: Health insurance covers the costs of medical expenses if you become ill or injured. It helps to reduce the financial burden of medical expenses.

3、Home and Property Insurance: This type of insurance covers your home and property against damage or loss due to events such as fire, theft, or natural disasters.

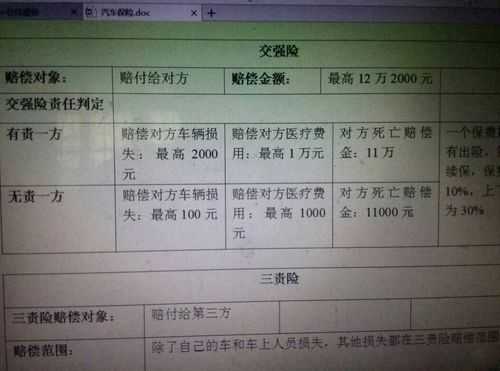

4、Auto Insurance: Auto insurance protects you against financial losses if your car is damaged or stolen, or if you cause an accident.

5、Business Insurance: Business insurance covers various risks that businesses may face, such as property damage, liability, and business interruption.

III. Benefits of Insurance

Insurance provides numerous benefits to individuals and businesses. Some of the key benefits include:

1、Financial Security: Insurance provides financial protection against potential losses, giving you peace of mind and security.

2、Risk Management: Insurance helps you manage risks by transferring them to an insurance company. This allows you to focus on other aspects of your life or business without worrying about potential losses.

3、Cost Savings: Insurance can help you save money in the long run by covering the costs of losses that could be expensive otherwise.

4、Peace of Mind: Knowing that you are protected against potential losses can give you a sense of peace and security, allowing you to focus on other aspects of your life.

IV. How to Choose the Right Insurance Policy for You?

Choosing the right insurance policy for you requires careful consideration of your needs and financial situation. Here are some tips to help you choose the right policy:

1、Identify Your Needs: Determine what risks you want to protect against and what type of insurance would be appropriate for your situation.

2、Compare Policies: Compare different policies and their features to find one that meets your needs and budget. Consider factors such as coverage, premiums, and claims process.

3、Consider Your Budget: Determine how much you can afford to pay for insurance each month or year and choose a policy that fits within your budget.

4、Read the Policy: Make sure you understand the terms and conditions of the policy before purchasing it. Read the policy carefully and ask any questions you have about it before making a decision.

V. Conclusion

In conclusion, insurance is an essential part of our financial security that provides financial protection against potential losses. There are various types of insurance available that cover different risks, and each individual or business should consider their needs and budget to choose the right policy for them. Understanding the benefits of insurance and how it works can help you make informed decisions about your insurance needs and protect yourself from potential financial losses in the future.